Clearway Energy, Inc. Announces Equity Commitment in Repowering Partnership

PRINCETON, NJ — Clearway Energy, Inc. (NYSE: CWEN, CWEN.A) (“Company”), today announced that, through an indirect subsidiary of the Company, it has entered into binding equity commitment agreements in the previously announced partnership with Clearway Group to enable the repowering of two of its existing wind assets, Wildorado and Elbow Creek. These agreements commit the Company to invest an estimated $111 million in net corporate capital[1], subject to closing adjustments. The transaction is expected to contribute incremental asset CAFD on an average annual basis of approximately $12 million beginning in 2020[2], which reflects the improved operational profile of the projects and the impact from the new non-recourse capital structure employed at the partnership.

“Our commitment to invest in the repowering of these two important wind assets highlights a new area of organic growth for the Company,” said Christopher Sotos, Clearway Energy, Inc.’s President and Chief Executive Officer. “We are pleased to achieve this important milestone in collaboration with our partner Clearway Group and look forward to working together in the future to prudently and accretively repower other projects in the Company’s portfolio.”

“Repowering our wind energy assets will extend the life of these projects with modern technology that is more efficient and cost-effective than ever,” said Craig Cornelius, Chief Executive Officer at Clearway Group. “We’re proud to collaborate on this important investment and continue to play a leading role in our nation’s growing clean energy economy.”

Highlights of the transaction include:

- 283 MW of Repowered Wind Projects: The 161 MW Wildorado Wind Project, located in Vega, TX, and the 122 MW Elbow Creek Wind Project, located in Howard County, TX

- Improved Operational Profile: Benefits of the repowering include the extension of design life, the reduction in operational and maintenance expenditures, and new warranty coverage

- Enhanced Contract Duration: Elbow Creek has entered into a new hedging arrangement with an investment-grade bank counterparty via which a majority of Elbow Creek’s output will now be contracted through 2029 rather than through 2022; the existing Wildorado PPA with a subsidiary of Xcel Energy (A-/A3) continues to run through 2027

- Non-Recourse Partnership Financing Summary: The partnership entered into a tax equity arrangement which, in combination with the Company’s equity investment, will be used to repay construction financing and costs related to the Repowering and to reduce outstanding principal at the existing Viento project financing through the removal of Wildorado from the Viento collateral package

- Corporate Funding Approach: The corporate capital commitment will be funded at Repowering COD of each project, will utilize existing corporate liquidity, and will have a limited impact on the Company’s corporate leverage ratio

- Construction Management: As part of the partnership, Clearway Group will manage all aspects of the construction process

- Technology: Siemens Gamesa Renewable Energy turbines.

The Company expects to fully close the transaction by the end of 2019. Completion of the investment is subject to customary closing conditions, including approval by the Public Utility Commission of Texas.

About Clearway Energy, Inc.

Clearway Energy, Inc. is a leading publicly-traded energy infrastructure investor focused on modern, sustainable and long-term contracted assets across North America. Clearway Energy’s environmentally-sound asset portfolio includes over 7,000 megawatts of wind, solar and natural gas-fired power generation facilities, as well as district energy systems. Through this diversified and contracted portfolio, Clearway Energy endeavors to provide its investors with stable and growing dividend income. Clearway Energy’s Class C and Class A common stock are traded on the New York Stock Exchange under the symbols CWEN and CWEN.A, respectively. Clearway Energy, Inc. is sponsored by its controlling investor Global Infrastructure Partners (GIP), an independent infrastructure fund manager that invests in infrastructure and businesses in both OECD and select emerging market countries, through GIP’s portfolio company, Clearway Energy Group.

About Clearway Energy Group

Clearway Energy Group is accelerating the world’s transformation to a clean energy future. With more than 4.1 gigawatts of solar and wind energy assets in 25 states and a development pipeline across the country, we are offsetting the equivalent of nearly 9 million tons of carbon emissions for our customers. The company is headquartered in San Francisco, CA with offices in Carlsbad, CA; Scottsdale, AZ; Houston, TX; and New York, NY. For more information, visit www.clearwayenergygroup.com.

Safe Harbor Disclosure

This news release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward-looking statements are subject to certain risks, uncertainties and assumptions, and typically can be identified by the use of words such as “expect,” “estimate,” “anticipate,” “forecast,” “plan,” “outlook,” “believe” and similar terms. Such forward-looking statements include, but are not limited to, statements regarding the potential operational and economic benefits of the Repowering transaction. These forward-looking statements are subject to a variety of risks and uncertainties. Such risks and uncertainties include, but are not limited to, the possibility that the operational and financial benefits of the Repowering transaction will not be realized, as well as factors described from time to time in Clearway Energy, Inc.’s filings with the Securities and Exchange Commission at www.sec.gov. In addition, Clearway Energy, Inc. makes available free of charge at www.clearwayenergy.com copies of materials it files with, or furnishes to, the SEC.

Although Clearway Energy, Inc. believes that the expectations are reasonable, it can give no assurance that these expectations will prove to be correct, and actual results may vary materially. Clearway Energy, Inc. undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. The Adjusted EBITDA and Cash Available for Distribution are estimates as of today’s date, June 17, 2019, and are based on assumptions believed to be reasonable as of this date. Clearway Energy, Inc. expressly disclaims any current intention to update such guidance.

# # #

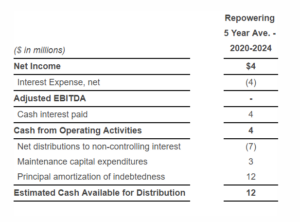

Appendix Table A-1: Adjusted EBITDA and Cash Available for Distribution Reconciliation

The following table summarizes the calculation of Estimated Cash Available for Distribution and provides a reconciliation to Net Income/(Loss):

EBITDA and Adjusted EBITDA are non-GAAP financial measures. These measurements are not recognized in accordance with GAAP and should not be viewed as an alternative to GAAP measures of performance. The presentation of Adjusted EBITDA should not be construed as an inference that Clearway Energy’s future results will be unaffected by unusual or non-recurring items.

EBITDA represents net income before interest (including loss on debt extinguishment), taxes, depreciation and amortization. EBITDA is presented because Clearway Energy considers it an important supplemental measure of its performance and believes debt and equity holders frequently use EBITDA to analyze operating performance and debt service capacity. EBITDA has limitations as an analytical tool, and you should not consider it in isolation, or as a substitute for analysis of our operating results as reported under GAAP. Some of these limitations are:

EBITDA does not reflect cash expenditures, or future requirements for capital expenditures, or contractual commitments;

EBITDA does not reflect changes in, or cash requirements for, working capital needs;

EBITDA does not reflect the significant interest expense, or the cash requirements necessary to service interest or principal payments, on debt or cash income tax payments;

Although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and EBITDA does not reflect any cash requirements for such replacements; and

Other companies in this industry may calculate EBITDA differently than Clearway Energy does, limiting its usefulness as a comparative measure.

Because of these limitations, EBITDA should not be considered as a measure of discretionary cash available to use to invest in the growth of Clearway Energy’s business. Clearway Energy compensates for these limitations by relying primarily on our GAAP results and using EBITDA and Adjusted EBITDA only supplementally. See the statements of cash flow included in the financial statements that are a part of this news release.

Adjusted EBITDA is presented as a further supplemental measure of operating performance. Adjusted EBITDA represents EBITDA adjusted for mark-to-market gains or losses, non-cash equity compensation expense, asset write offs and impairments; and factors which we do not consider indicative of future operating performance such as transition and integration related costs. The reader is encouraged to evaluate each adjustment and the reasons Clearway Energy considers it appropriate for supplemental analysis. As an analytical tool, Adjusted EBITDA is subject to all of the limitations applicable to EBITDA. In addition, in evaluating Adjusted EBITDA, the reader should be aware that in the future Clearway Energy may incur expenses similar to the adjustments in this news release.

Management believes Adjusted EBITDA is useful to investors and other users of our financial statements in evaluating our operating performance because it provides them with an additional tool to compare business performance across companies and across periods. This measure is widely used by investors to measure a company’s operating performance without regard to items such as interest expense, taxes, depreciation and amortization, which can vary substantially from company to company depending upon accounting methods and book value of assets, capital structure and the method by which assets were acquired.

Additionally, Management believes that investors commonly adjust EBITDA information to eliminate the effect of restructuring and other expenses, which vary widely from company to company and impair comparability. As we define it, Adjusted EBITDA represents EBITDA adjusted for the effects of impairment losses, gains or losses on sales, non-cash equity compensation expense, dispositions or retirements of assets, any mark-to-market gains or losses from accounting for derivatives, adjustments to exclude gains or losses on the repurchase, modification or extinguishment of debt, and any extraordinary, unusual or non-recurring items plus adjustments to reflect the Adjusted EBITDA from our unconsolidated investments. We adjust for these items in our Adjusted EBITDA as our management believes that these items would distort their ability to efficiently view and assess our core operating trends.

In summary, our management uses Adjusted EBITDA as a measure of operating performance to assist in comparing performance from period to period on a consistent basis and to readily view operating trends, as a measure for planning and forecasting overall expectations and for evaluating actual results against such expectations, and in communications with our Board of Directors, shareholders, creditors, analysts and investors concerning our financial performance.

Cash Available for Distribution (CAFD) is Adjusted EBITDA plus cash distributions/return of investment from unconsolidated affiliates, adjustments to reflect CAFD generated by unconsolidated investments that are unable to distribute project dividends due to the PG&E bankruptcy, cash receipts from notes receivable, cash distributions from noncontrolling interests, less cash distributions to noncontrolling interests, maintenance capital expenditures, pro-rata adjusted EBITDA from unconsolidated affiliates, cash interest paid, income taxes paid, principal amortization of indebtedness, Walnut Creek investment payments, changes in prepaid and accrued capacity payments, and adjusted for development expenses. Management believes CAFD is a relevant supplemental measure of the Company’s ability to earn and distribute cash returns to investors.

We believe CAFD is useful to investors in evaluating our operating performance because securities analysts and other interested parties use such calculations as a measure of our ability to make quarterly distributions. In addition, CAFD is used by our management team for determining future acquisitions and managing our growth. The GAAP measure most directly comparable to CAFD is cash provided by operating activities.

However, CAFD has limitations as an analytical tool because it does not include changes in operating assets and liabilities and excludes the effect of certain other cash flow items, all of which could have a material effect on our financial condition and results from operations. CAFD is a non GAAP measure and should not be considered an alternative to cash provided by operating activities or any other performance or liquidity measure determined in accordance with GAAP, nor is it indicative of funds available to fund our cash needs. In addition, our calculations of CAFD are not necessarily comparable to CAFD as calculated by other companies. Investors should not rely on these measures as a substitute for any GAAP measure, including cash provided by operating activities.

[1] Net corporate capital is subject to closing adjustments; however, per terms of the partnership agreement, the Company’s asset level CAFD yield will be no lower than 11% at closing

[2] CAFD average over the 5-year period from 2020-2024 and is based on the currently estimated net corporate capital commitment

Contacts

Investors:

Akil Marsh

akil.marsh@clearwayenergy.com

609-608-1500

Media Contact:

Zadie Oleksiw

Director, Communications

zadie.oleksiw@clearwayenergy.com